The Guam International Airport Authority has completed the successful sale of $67.8 million in bonds to municipal investors. The sale was made through a first-of-its-kind standalone tender offer for the island.

GIAA had refinanced the bond which led to a 4.27% All in True Interest Cost and savings of $3.23 million over the remaining term of the bonds through fiscal 2043 according to a Sept. 18 release by the airport.

Additionally, strong interest in the bonds led to lower borrowing rates, in which the bonds were oversubscribed by 9.3 times. This interest was also influenced by GIAA strong credit and the upgrade to the Government of Guam’s General Fund credit rating, said the airport.

Interest rates were at its peak levels in Fall 2023 and have fallen since. This, and the tender and refinancing structure allowed the airport to buy bonds it could not have refinanced otherwise, said GIAA. mbj

GIAA sells $67.8 million in bonds to municipal market

Recommended Articles...

Greater Bay Airlines to fly NMI and Guam in late 2025-2026

Hong Kong based carrier, Greater Bay Airlines, has filed for a U.S. Foreign Air Carrier Permit to start scheduling flights to Guam and the Northern Mariana Islands.

Read More

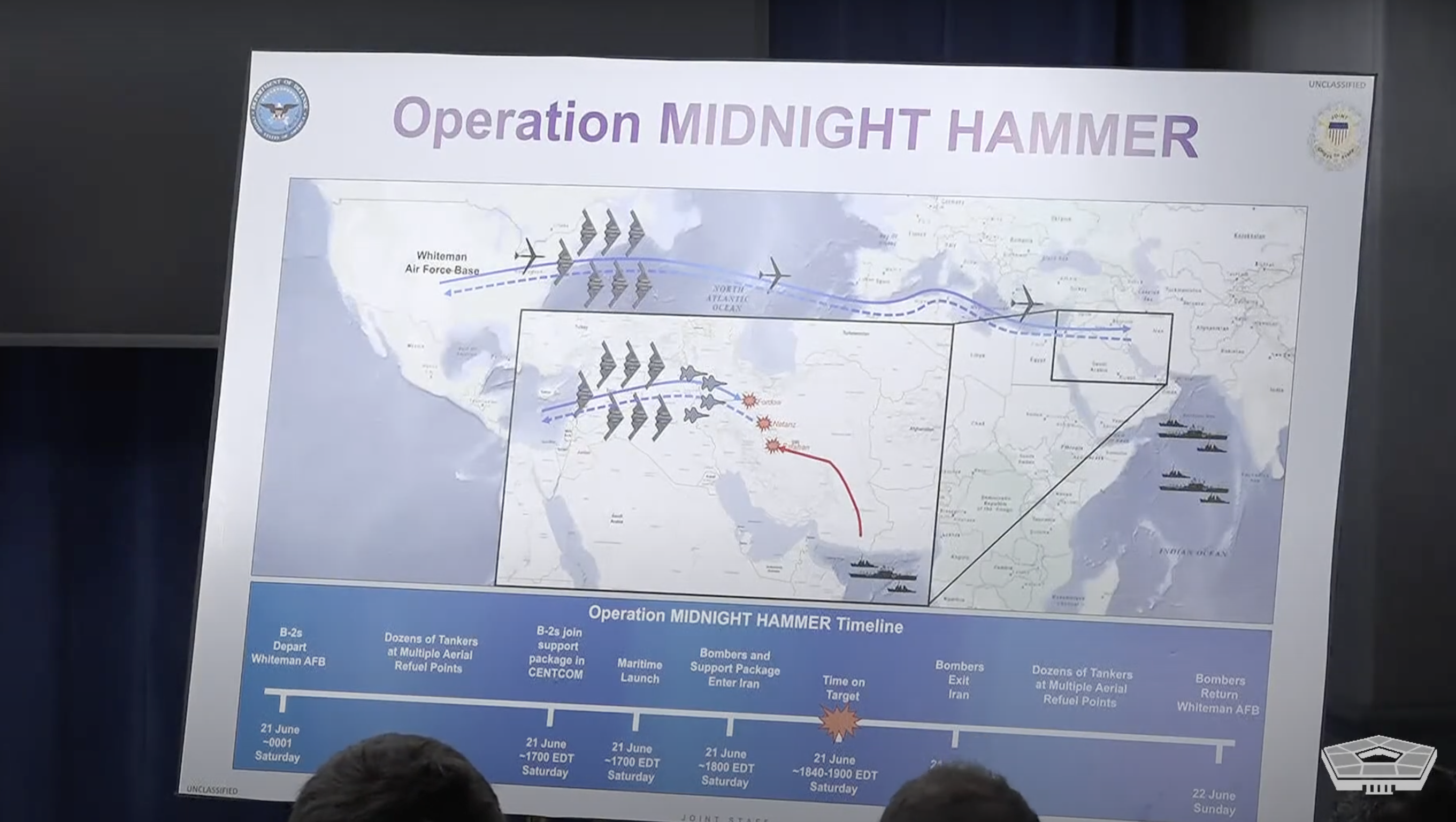

Secretary Hegseth and Gen. Caine discuss Operation Midnight Hammer with media

Secretary of Defense Pete Hegseth and Chairman of the Joint Chiefs of Staff General Dan Caine held a press conference at the Pentagon on Sunday evening (ChST).

Read More

Adelup: No B-2 Bombers on Guam; residents warned to beware of cyber attacks

There are no B-2 bombers on Guam and there won’t be any in the near foreseeable future, according to Adelup.

Read More

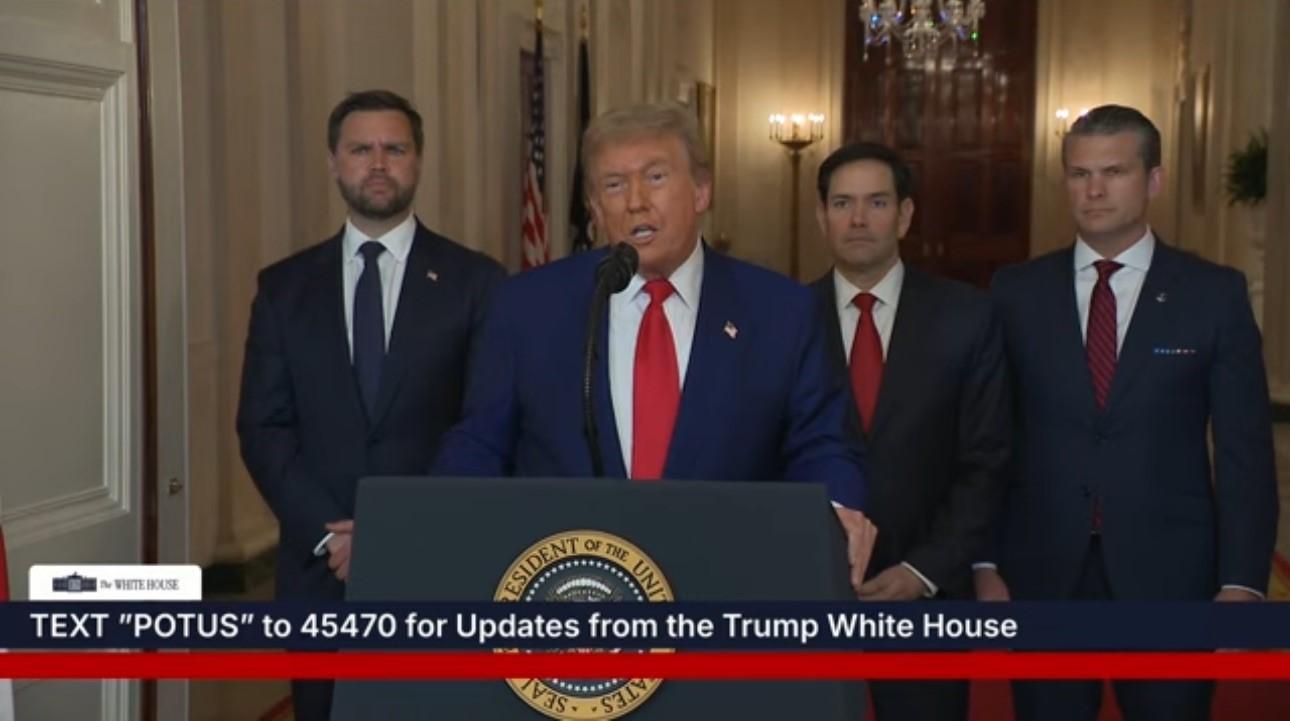

Leon Guerrero issues statement following U.S. strike on Iran facilities

Shortly after President Donald J. Trump announced military strikes on three Iranian nuclear facilities, Gov. Lourdes A. Leon Guerrero issued a statement reiterating there are no credible threats to Guam.